Q1 2022 Commercial Real Estate Market Overview

Commercial real estate investment activity remained robust heading into 2022. Total U.S. commercial real estate investment volume in Q1 2022 was $150 billion, a strong 45% increase from the same period in 2021. The volume in Q1 2022 was quite significantly lower than the $296 billion in Q4 2021, but one must note that Q4 was an all-time historically high volume created by pent-up demand as well as an anticipation of interest rate hikes. Multifamily continued to lead the sectors in investment volume with $57 billion transacted in Q1, up 42% from the same quarter last year. Industrial properties and office were the next two largest sectors with $42 billion in volume in the quarter. Although only at $17 billion transacted in the quarter, the retail section showed strong signs of recovery, showing a strong 87.3% growth compared to the same quarter last year.

When we rank the cities by investment volume in the past 12 months, the top 10 cities are dominated by very large and mature markets led by New York, Los Angeles, and Dallas. Our Fund currently has assets in some of the larger markets as well, including Dallas (3rd at $49bn), Atlanta (5th at $39bn), and Chicago (10th at $25bn). However, what is particularly noteworthy is the next 10 on the list, most of which are markets that this Fund watches very closely and invests quite heavily in, including: Austin (14th at $18bn), Orlando (16th at $14bn), Charlotte (17th at $13bn), Raleigh/Durham (19th at $13bn), Tampa (20th at $12bn). We believe these secondary markets offer more attractive risk and return profiles than the larger and more mature markets. Multifamily and industrial assets are still seeing the most investment for good reason; however, retail investment activity has increased as retail sales continues to recover as U.S. economy opens up.

Persistent inflation has not dampened real estate activity thus far, but the rest of 2022 could prove challenging if current economic concerns persist or worsen. Inflation generally boosts real estate prices in the short term as wages and rents increase, while the counterbalance of higher maintenance and repair costs is slightly muted in comparison. However, prolonged inflation tends to stunt economic growth, so the longevity of inflation is a factor we are observing very closely.

As far as interest rates go, rising rates in the short term can cause dramatic discounts to real estate prices. When the Federal Reserve raises its target rate, that in turn causes market participants to immediately demand a higher % rate of return. This means for the same asset producing the same amount of rent, if the rate of return demanded is higher, the asset’s market price is then discounted as a result. At the same time, the current rate hike is coupled with inflation, which leads to increases in wages and rents, which will likely offset some of the adverse impacts of rate hikes.

U.S. Commercial Real Estate Investment Volume by Quarter

U.S. Commercial Real Estate Investment Volume by Sector

U.S. Commercial Real Estate Investment Volume by Market (Last 4 Quarters)

U.S. Real Estate – Multifamily Market

The multifamily market enjoyed the strongest Q1 absorption in more than two decades, leasing up 96,500 units during the quarter. Typically, the first quarter is seasonally a slow quarter, however, strong pent-up demand in the sector overcame that trend. The continued robust demand for multifamily housing was fueled by a number of factors, including: increased household formations coming out of COVID, job and wage growth due to economic strength and inflation, as well as ever-increasing home prices which drives residents into rental apartments.

The overall multifamily vacancy rate in the U.S. fell to a record-low of 2.3%. This is a compression of 0.2% quarter-over-quarter from Q4, and 2.5% year-over-year from last year’s Q1. This is going to give our property managers the ability to push rents even more aggressively on renewals and new leases.

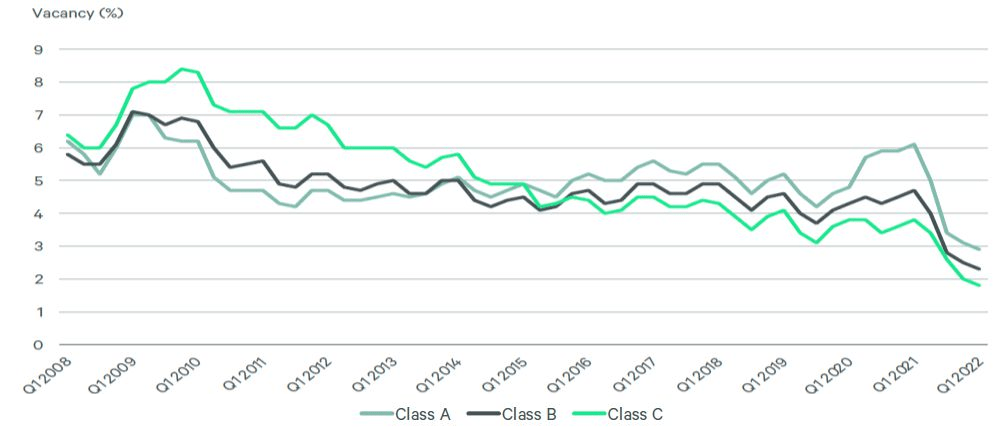

During the pandemic, the spread in vacancy rates among Class A, Class B, and Class C properties expanded widely compared to historical ranges. Since Class A properties are largely located within more densely populated city centers, many renters escaped those areas to lower density cities, which tended to be mostly Class B and C properties. Many employers during the past two years also allowed workers to work remotely from these Class B and Class C locations, even while these companies maintained their office in the city centers, further supporting the flight to Class B & C. However, in the second half of 2021 we saw a sharp reversion as more companies brought employees back into the office, and the general pandemic concerns subsided. By Q4 2021 and continuing into Q1 2022, the spread now seems to be more “normal” given historical trends, with Class A vacancy rate being approximately 0.5% higher than Class B, and Class B vacancy rate being approximately 0.5% higher than Class C. That said, all three classes of multifamily individually continued to break new lows each quarter.

As a result of historically low vacancy and high inflation rates, average rents increased by 2% quarterover-quarter and 15.5% year-over-year. While this is the trend observed across the country, we operate each of the properties in the portfolio based on its own unique aspects including its location, tenant base, size of units, amenities, etc. At each property, the Fund generally instructs our property managers to prioritize rent growth, both for the purpose of increase rental income as well as potential sale price at exit. However increasing rents too aggressively above what the market can bear, can cause vacancy to rise at the property, which creates a loss of income and negatively impacts future sale price. Therefore, it is a delicate balance we maintain by constantly monitoring rents and vacancy, as well as each individual property’s competition in its submarket.

U.S. Multifamily Vacancy Rate and YoY % Change

U.S. Multifamily Vacancy Rate by Class

U.S. Multifamily Monthly Rent and YoY % Change

U.S. Real Estate – Commercial Retail Market

In the first quarter of 2022, commercial retail market continued to recover. Not surprisingly, in-store sales saw higher increase than online sales as consumer behavior somewhat shifts spending back to physical retail stores. The fear of inflation and potential recession curbed consumer confidence, but nonetheless, strong wage growth and inflation drove overall retail sales up. Not surprisingly, sales of gasoline spiked due to heightened demand and the conflict in Ukraine. Restaurants and bars also saw large increases along with other in-store retailers.

Another point worth noting, is that during the past 2 years, there was minimal new construction of retail properties across the country. This kept the total supply of available retail units, which helps to maintain retail property rent levels.

While the retail sector is not the most critical focus of the Fund, it is important to maintain some diversification. Therefore, retail exposure is kept fairly low in our portfolio, and limited to only certain specific markets.

U.S. Consumer Retail Sales Growth and YoY% Change

U.S. Retail Sales by Category

U.S. Retail Vacancy Rate by Property Type

U.S. Retail Average Asking Rent

Data Sources: CBRE Research, CBRE Econometric Advisors, CoStar Realty Information Inc., Bloomberg, Zillow Group, Redfin

For additional information, please contact:

Grandway Group

Email: Info@grandway.com

Tel: +1 626-357-1200